An employee handbook is useful for restaurant payroll management purposes, as well as documenting company culture, expectations, and policies. W-4 is essential for you to calculate how much federal tax to withhold from an employee’s paycheck. I-9 is necessary to verify an employee’s work eligibility and is submitted to the U.S. Lightspeed is a cloud-based commerce platform powering small and medium-sized businesses in over 100 countries around the world.

Sometimes you have an employee who has multiple positions and makes different hourly wages by position. For example, a server and a server trainer could easily be the same person. Some companies do a weighted average and that’s an approach that is great for a payroll company. The way to calculate gross pay and labor costs for a restaurant is relatively simple.

Accurate Employee Information

Instead, go back to doing what you love and let a payroll service or payroll software application do the heavy lifting for you. If the tip credit does not meet minimum wage requirements, you have to make up the difference. Overtime is calculated on the full minimum wage — not the cash wage payment minus the tip credit. Next, deduct state withholding.Now, be careful here because different states have different tax rates and rules. Reference the Bureau of Labor Statistics for information on how each state calculates state income tax withholding to figure out how much to deduct.

You can add on integrated benefits, a 401 plan, or pay-as-you-go workers’ comp. Payroll costs typically include the cost of both hourly and salaried employees, plus employee benefits.

Giundiuz Osmanov is CEO and cofounder of NumberSquad, which automates bookkeeping, tax, and payroll processing for small businesses. He is an IRS Enrolled Agent and he has a Masters Degree in Business. In case you tip credits, you can also file IRS FORM 8846, i.e., credit for Employer Social Security and Medicare Taxes. Moreover, some restaurants use FORM 8846 to obtain credit in a portion of social security and medicare taxes paid by them in place of their employee. Remember that you are required to pay all of your employees’ full minimum wage instead of reduced wage if your policy allows sharing tips.

How Do Restaurants Do Payroll Example?

Employees must record and report to you all tipped income if they receive $20 or more in tips in a month, including tips paid via a tip pool, cash, check, debit card, and credit card. Understanding the ins and outs of tip pay is one of the more significant payroll challenges facing restaurant owners and managers. While tips are generally off-limits to employers, they do have a role to play in ensuring tips are treated according to federal and state rules. If the amount of tips an employee receives is not enough to bring the employee up to the federal or state minimum wage , then the employer is responsible for making up the difference. However, in many cases, the amount of tips does cover the difference between the tipped employee minimum wage and the regular minimum wage. Several states and cities have higher minimum wage rates than the federal minimums, and it is important to be aware of changes, which typically happen January 1 or July 1.

Her work has been featured on SCORE.org, G2, and Fairygodboss, among others. While Wave Payroll has fairly standard features at a fairly standard price, its completely free accounting software makes it a good pick for restaurant owners who want to save money wherever possible. If you already use Square Point of Sale, Square Payroll is the perfect add-on. When you use the two together, you can easily import credit card tip amounts and employee hours worked to process payroll quickly and accurately.

Further, the complexities around staying legally obedient and paying the staff on time can add to the stress levels. We help keep you compliant with your state’s minimum wage laws and make sure your employees receive their accurate pay. Some may be receiving some form of government assistance, while others may have recently been released from the military, or perhaps jail. In these instances, if your restaurant hires such individuals, you can get up to $2,300 in tax credits after that employee has accrued 300 hours of work. There’s more to consider than accurately processing payroll and paying your employees on time.

This payroll guidewill predominantly refer to the term “payroll” as the act or process of calculating and distributing wages to restaurant employees. Wagemate provides reliable, tailored, and affordable payroll services and solutions for restaurants in London and the surrounding areas. Cultivating an environment of personal accountability and punctuality can significantly reduce payroll costs over time. When your staff shows up on time and takes pride in their work, great things happen.

Know Your Minimum Wage For Tipped Employees

We provide an all-in-one solution that streamlines manual, paper-based processes so you can focus on delivering a great customer experience. Using payroll software is a great alternative to hiring a payroll specialist or agency to manage your restaurant’s payroll, or doing it the old-school pen-and-paper way. They’re also incredibly useful for keeping records (which we’ll cover later).

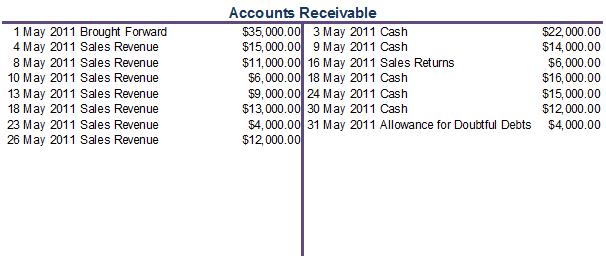

As a general rule, you debit Gross Wage Expense and credit every liability account when recording payroll. For expanded features, Toast offers custom pricing, so you will need to contact them directly to see what your quote will be. However, Toast is currently running a special, offering its POS service plus its Payroll Lite plan for $110/month + $4/month per employee.

In addition, restaurant employees must track their daily tips and provide their employer with a monthly tip report for any month in which their total tips received was $20 or more. They may use IRS Form 4070 for this purpose or custom forms and electronic systems supplied by their employer. If your restaurant management software is fully integrated with your point of sale system, you have access to powerful tools that can help you reduce payroll costs. This integration allows you to automatically pull historical sales data for your restaurant, which can inform your scheduling and help you track your payroll percentage. With this information at your fingertips, you can also track whether or not you are meeting your labor cost goals and make changes in the moment that prevent costly, drawn-out inefficiencies. In the restaurant industry, most positions are paid on an hourly basis, except for front of house and kitchen management.

$36 + $4 Per Person Each Month

It can be intimidating, but by preparing yourself with the right information and tools, you can make it a bit easier. We hope this restaurant payroll guide has demystified the payroll process for you and has empowered you to take on your payroll with a newfound confidence in 2022. Hiring someone to do payroll will vary drastically on the size and type of company. If the company is small, a CPA or other professional firm might cost anywhere from $2,500-$5,000 depending on complexity .

It’s important to keep up-to-date on these changes, which generally occur on January 1 or July 1. In addition, How to Do Payroll for Restaurants states may have different tip credits, so be sure to check your state’s department of labor.

Unique 4th Of July Restaurant Specials And Promotion Ideas For 2022

Given that restaurants operate on weekends, I also prioritized providers that offer live phone support and a dedicated representative. Gusto, QuickBooks Payroll, and OnPay scored the highest in this criterion. In our evaluation, SurePayroll earned an overall score of 3.72 out of 5. The software earned high scores for pricing, HR tools, and reporting capabilities.

- Note that you must purchase its Elite plan to have your errors covered.

- However, managers and supervisory employees are prohibited from participating in a tip pool.

- You may only need easy-to-use payroll software, or you may be looking for solutions to make other aspects of HR simpler.

- If you’re not computer-savvy, it’s easy to hire a manager who can learn to process payroll.

- Would expanding your to-go offering positively affect sales while keeping labor costs relatively steady?

- Gross pay is the basis for all the other calculations you’ll perform before you reach the net amount that you’ll write on each employee’s check.

Employers who take a tip credit can set up a tip pooling system but must limit it to tipped employees. There is no federal limit on maximum contribution to a mandatory tip pool, but employers are required to notify tipped employees of any required tip pool contribution. You must report the total tips submitted by your employees for the payroll period, as well as their work hours and hourly rates to the IRS. This information will also appear on your Employers Quarterly Payroll Tax Return form. There are federal provisions for tipped employees who work overtime, requiring overtime pay for hours worked over 40 per workweek, at a rate not less than one and a half times the regular rate of pay. Running a restaurant involves many expenses which may quickly deplete your business bank account funds. Therefore, it’s important to have a separate account with adequate funds at all times for paying employees at the end of the payroll period.

Options For Handling Payroll In

We surveyed 1,000 consumers and 500 restaurant owners to find out what the top restaurant trends are for businesses in 2022. From contactless ordering to customer loyalty, learn about the biggest bets the restaurant industry is making this year. When it comes to overtime, it’s really important that you know your state’s laws. If the law for overtime is anything over 40 hours in a week, then you can probably work someone four days at 10 hours per day. But if the overtime law says overtime kicks in anytime you work someone over eight hours per day, you owe overtime. The more efficiently you run your payroll, the more time you’ll have to put toward running your restaurant.

- Aside from monitoring your employees’ and contractors’ time through its system or via the Gusto Wallet, Gusto offers project tracking and workforce costing tools.

- The online ordering has been the perfect tool, especially with the ongoing COVID-19 pandemic as customers choose to limit face to face interaction.

- However, if you choose not to begin a tipping approach, your employees will simply hold their own tips.

- Consider the advantages and disadvantages of each method of paying employees before making a decision.

First, you must determine the hours worked by each employee from your time clock or timesheets. 7shifts users can use our 7punches time clocking system to easily integrate their time clock, schedule, and payroll, making tracking the numbers of hours worked easier. Calculating how much money your business owes employees and contractors during a specific pay period. Leave behind the stress of calculating employee wages and conducting time-consuming restaurant server interviews. With Qwick, you choose what you want to pay for every shift, and only pay a small 40% fee for the on-demand service. With a 14-point assessment and in-depth interviews, we carefully vet each candidate to ensure that qualified Professionals are on the platform. A special provision for businesses in the food and beverage industry is called the FICA Tax Tip Credit.

How Long Do You Need To Keep Payroll Records?

Some payroll services offer discounts for a monthly payroll, but it’s hard for minimum-wage earners to wait a month for their pay. Monthly payroll saves money, but that works best for fine dining restaurants where the chefs earn high salaries and the servers take home big tips daily. Your restaurant payroll company should make your process easy, accurate, and efficient. Homebase ensures your payroll process is automated, simple, and error-free. We’ll even run payroll summary reports and prevent payroll fraud for you so you don’t have to worry. If you’re in a tip credit state, you have to pay overtime at minimum wage. If your sales are really slow during a specific shift, and you have a server working at the tip credit wage, and the tips don’t cover the hourly wage, then you owe them minimum wage.

Your restaurant’s payroll may look a little different than another restaurant’s or business’s payroll depending on if you allow tips, have multiple pay rates for different jobs, etc. And, employees are required to claim all tip income received, including cash tips and tips from credit cards. Employers must collect income tax, employee Social Security tax, and employee Medicare tax on tips reported by employees. Consider the advantages and disadvantages of each method of paying employees before making a decision. Ask yourself questions, like Can I afford to pay employees using this method? Like with payment schedules, you also need to review payment laws (e.g., direct deposit laws by state) to make sure you are compliant. If you want to work with a payroll service but don’t know how to find one, we recommend asking other restaurateurs for recommendations.

The best payroll software for restaurants includes solutions and services designed to automate your tasks and align with your goals. An investment in the right restaurant payroll software is a partnership built on a foundation that supports your success. Many people look for employers that offer various payment methods that fit their needs. Payroll software that provides the flexibility of multiple pay options can give you a competitive advantage. These payment methods include direct deposit, paycards, and earned wage access.

Have someone on staff who can manage relations with the payroll service. Benefits enrollment and election forms for perks like employer-sponsored retirement savings accounts, health insurance, and commuter benefits.

Your entire menu is covered by Toast’s all-in-one, point-of-sale, restaurant payroll. SurePayroll’s basic feature set before add-ons is somewhat limited, but likely functional for a smaller food-service establishment. And if you’re happy with the product’s ease https://accountingcoaching.online/ of use and find yourself needing additional features, the product is highly scaleable . You can allocate tips based on a good-faith agreement between you and your employees. This is a written agreement that explains how you will allocate tips among employees.